Cryptocurrencies: higher transaction fees, slower transaction times, and zero consumer protections compared to just using a credit card.

On the other hand, crypto is also terrible for the environment.

That depends entirely on the currency.

Ethereum l2 has way lower (less than a tenth) transaction fees than credit cards and barely has an impact at all on the environment because there is no mining.

And cryptocurrencies do have consumer protection services but no one ever uses them.

More importantly, however, Visa and mastercard collude and boycott japanese anime and manga websites because they think anime and manga promote gender stereotypes, so credit cards can fuck right off.

Credit card fees can actually get quite large as well, they’re just hidden from the consumer, and we all pay a higher price because of it.

E.g stripe is 2.9% + $0.30

Even BTC with its current high (not peak high fees) fees is cheaper than CC’s when you start getting into a few hundred dollars purchase.

And many cryptocurrencies have much lower fees. For example, Monero fees tend to be <$0.01, though they can be as high as $1, which is way lower than Bitcoin. Here’s a source for Monero transaction fees. And that absolutely tracks for Monero since it’s entire purpose is to replicate cash transactions as much as possible.

Don’t forget how easy it is to launder money with cryptocurrency.

Also useless if you don’t have electricity or an Internet connection.

That’s not entirely accurate. Look up Caesaceous coins. There aren’t many of them, but they do exist, and they are physical coins with a private key embedded under a hologram, which as long as the hologram has not been tampered with, is guaranteed to contain the amount of crypto it says, and you can trade that without electricity or internet.

So it’s just a significantly more complicated and expensive coin.

I’m not sure how much more expensive it is, but I wouldn’t think it would add much to the price of the actual crypto that’s in it.

Until that gets common acceptance at places like grocery stores, I’ll stand by what I said.

But what u said got nothing to do with common usage.

Of course it does. You can’t use a physical token if nobody will accept it as payment.

U said its useless if u dont have electricity and an internet connection. If u meant to talk about it being usless if its not widely accepted then u should have talked about that instead of talking about an already solved issue. Words have meanings thats their purpose if u use them to convey an idea when u actually meant to convey a completly different idea then perhaps u should have used completly different words?

But unless you use Monero or other crypto with similarly strong privacy all you do is leave a permanent trail for agencies to investigate.

Using shell companies on the Cayman Islands might be the safer approach.And even with Monero, it’s about the same as physical cash, if you avoid the bank reporting for suspicious transactions. And if the police are suspicious, Monero is arguably worse because there’s the possibility to get transaction data if the police can access your device, whereas that’s not a thing w/ cash. And then you still have the issue of converting back to fiat, which either involves a KYC service (in most countries) or P2P cash transactions, in which case we’re back to cash.

Money laundering will happen regardless, and IMO it’s not worth the privacy violations required to attempt to eradicate.

Or just bypass illegal sanctions.

All of those points are true for some crypto projects, and untrue for others. There are some projects with their own Blockchain that have ultra-low fees, others with quick transactions, and others whose algorithms are much more environmentally friendly. (There are other projects and tokens they are full-on scams with no redeeming value whatsoever).

And consumer protections are something that can be added to crypto, but out of necessity they involve trusting some entity to arbitrate when protection is required. Cryptocurrency is designed to be trustless, so any protections need to be added on top, like the escrow someone else talked about.

The worst thing that ever happened to crypto was for it’s price to balloon. Because improving all those other aspects that make it usable as a currency took a back seat to “wen moon?”. OG Bitcoin explicitly rejects improving its energy footprint and fee structure because it sees itself as a Store of Value.

If ur using shitcoins and memecoins sure. If ur using monero then u have significantly lower transaction fees, zero surveillance, zero advertiser tracking, and u cant be debanked or have ur funds frozen.

U still have consumer protections when ur using it as a currency (like intended) cos its not like someone selling something for monero is suddenly above the law just means that if u send ur money to a Nigerian prince u aint getting it back, ohh and u can still use crytpo through a traditional exchange with all of said consumer protections.

Monero transactions are mined every minute and can be verified instantly. To fool this u would either need to make multiple transactions within the span of 1 minute (perfectly timed to the unpredictable timings of the blockchain) or collude with the entire network to delay mining a particular transaction.

The environmental impact of monero is extremely minimal compared to other coins due to it using an algorithm limmited by cpu cache not compute like most currancies. Also crypto is playing a significant role in providing a way to instantly shed load from the grid in responce to the unpredictable nature of renewable energy (most cryto mining operations make more money from selling energy to the minute by minute power grid than they do from mining crypto).

And it’s not like the traditional banking industry is energy efficient. I would argue that they use more power especially if you consider the lifestyle of banking executives.

The energy usage was criticized not in absolute terms, but in relation to the numbers of transactions. Cryptocurrencies are criticized for consuming more energy while being much lower in volume.

That said, we do need projects like Monero now. At least at the present moment, it is the closest we have to “digital cash”.

I’m sure a single mainframe consumes considerably more that some mining farms.

Define mainframe, because modern mainframes are just sets of regular rack servers (or rack form factor chassis servers). If you mean the old ones then yes, because they’re far less power efficient.

You’re dead wrong.

Have you ever heard of Bitcoin mining farms? Their electric energy consumption dwarfs a league of mainframes.

Am IBM Z16 may need several dozen kW at full load: https://www.ibm.com/docs/en/systems-hardware/zsystems/Z16M-A01?topic=requirements-general-electrical-power

Fully equipped with 8 PDUs and 4 BPAs a single mainframe is limited to an electric power of 173 kW.Well, the Bitcoin miners are estimated to use around 175 TWh of energy annually, which equals an electric power of around 20 GW : https://www.statista.com/statistics/881472/worldwide-bitcoin-energy-consumption/

This is several orders of magnitude above that of all the mainframes in the world - unless there are more than 116 million mainframes of that type in operation and running at full load.

Thats before u account for building a branch in every town/city, the cost of the employees driving to work, the driving of physical cash from place to place etc etc.

False, false, and mostly, if not entirely false.

-

Higher transaction fees: It is totally possible to send literally any amount of money around the world in a cryptocurrency for less than a penny on multiple different cryptocurrencies. You can send this amount of value from anywhere with an internet connection at any time of day or night and the receiver will have access to it very nearly instantly.

-

slower transaction times: Transactions on multiple ethereum layer two networks such as polygon or other layer one networks such as solana settle very nearly instantly and on bitcoin seven blocks is considered fully final with no possibility of reversal which takes 70 minutes and on Monero 10 blocks is considered final, which takes 20 minutes. A credit card transaction takes 3 days to fully settle, as does an ACH transaction.

-

Environmentally wasteful: How many resources does the banking sector use to build bank branches requiring mining of stone, etc. Electricity, gasoline to use armored cars, gasoline to transport employees to work, etc. Proof of work mining does indeed require a lot of electricity, but it also requires a lot of extremely cheap electricity. And a lot of extremely cheap electricity is renewable electricity such as hydro and solar. So a lot of proof of work mining uses these renewable resources. There are also other security mechanisms such as ethereum with the proof of stake method, which uses very little energy. And there are other more novel proof mechanisms such as proof of burn, etc. that also use very little energy.

-

Consumer protections: Any crypto commerce site worth its salt implements multi-signature escrow so that there are three parties to a transaction, the buyer, the seller, and an arbitrator if they are required. Since you can self-custody your cryptocurrency in your own wallet, you do not need to worry about protections from fraud, such as credit card theft, because it’s a push-based method and not a pull-based method. Some thought must be given to holding large amounts of what is basically cash, but that is easy enough to do through multi-signature accounts and keeping only a small amount of crypto on a mobile wallet or laptop at all times.

And for 3, pick a more environmentally friendly cryptocurrency, like Ethereum. Monero is probably also way more efficient than Bitcoin since it’s not profitable to mine, so you only get enthusiasts doing it instead of big mining operations.

It may be profitable to mine Monero, but the fact that it uses an algorithm that is strictly available on CPUs only helps keep the power usage way down because you can’t make specialized equipment and put it in a single location. That way, nobody has an advantage over anybody else except for the pure amount of CPUs they can purchase. But literally anybody that has a mobile phone or a computer of any kind can mind Monero if they wish.

Right, and all of that is why it’s unprofitable to mine Monero. So you end up with enthusiasts mining because they care about the platform, not because they’re trying to make money. Transaction costs stay low because there are a lot of enthusiasts, and energy use also stays low because mining farms aren’t really a thing, so there’s a lot less waste. I imagine a lot of people run a miner on a system that’s going to stay up 24/7 anyway (e.g. NAS or VPS that serves other data), so there isn’t really an increased amount of energy usage.

It’s nearly impossible to estimate how much energy it uses though, but I wouldn’t be surprised if it’s a blip compared to Bitcoin, even adjusted for total number of transactions processed.

Yep, that’s a totally fair point. I mine on the same machine that runs my node that I connect my mobile wallet to over tor and it runs a couple of other services for me, so I have to leave it on all the time anyway.

Yup, I’m planning on doing the same. I have a VPS that reverse proxies to my NAS, both of which run 24/7 and have very little CPU load normally. My VPS doesn’t allow crypto mining, but it probably allows running a node, or I can just pass it through to my NAS.

-

XRP at least has instant feeless payments. No consumer protection though. Some banks use it for intra-bank transfers.

XRP is fast, but neither instant (usually around 4 seconds) nor without fees:

https://xrpl.org/docs/concepts/transactions/transaction-costThe cherry on top is the skewed token distribution.

Thanks, but no thanks!

Most of these things are only true for bitcoin. Basically every other cryptocurrency is way more efficient, instant, and has extremely low fees. Bitcoin had a bit of a hostile takeover a few years ago because companies that run bitcoin exchanges wanted to incentivize their own alternatives where the exchanges could pocket more of the fees, and almost every problem in crypto now derives from that takeover.

All of what you say applies to most cryptocurrencies.

But I’m aware of at least one digital currency that is- without fees

- usually confirmed in less than one second

- eco-friendly because it requires no special hardware to operate the network and it uses very little energy

It has also zero inflation, is decentralized and designed with incentives that increase the degree of decentralization over time.

It also has no built-in limits regarding transactions per second.Consumer protection without middlemen/centralization is hardly possible.

I’m hesitant to drop a name here, because I don’t want to come across as a shill, but if you’re interested we can discuss the attributes of this gem.

edit: ah, the good old “I don’t like what I see, but I have no arguments, so I just downvote without engaging” approach. Or does it just sound too good to be true?

You know what, I’ve changed my mind: https://nano.org/enWhy not just GNU Taler? It has been around forever and can be deployed for pretty much any scale you want. Some places have used it for conferences and whatnot.

What it means for traditional banking is pretty much nothing, because the majority of the population don’t in fact think about currency any differently than they did in the pre-Internet era (and the only way they’ve changed how they think about banking is that they expect greater convenience and remote access). Crypto is an unsecured investment vehicle, not a currency, because the set of goods and services it can be directly, legally exchanged for is small.

Crypto is an unsecured investment vehicle, not a currency, because the set of goods and services it can be directly, legally exchanged for is small.

And it makes me sad. I really want cryptocurrencies to be useful for actual transactions, because it solves a lot of annoying problems, such as:

- international cash transfers - e.g. send a cash gift to a friend in another country

- person-to-person ad-hoc transactions - cash works, but cryptocurrencies can protect personal banking info for cashless transactions

- avoids network fees - credit/debit card companies charge fees to merchants, and businesses pass that on to customers; cryptocurrencies sidestep that entire system

But yes, the primary use right now of cryptocurrencies is speculation, which is incredibly annoying because that causes fluctuations, which discourages its use as a currency.

In the early days, we early adopters tried to bring it into circulation. I bought a few beers with it at the bar once. Sadly, it never kindled.

I’m still holding out hope. We’ll see what happens.

It did kindle. Major companies started accepting it. Then the blocksize wars happened, and the 1mb forever people won through massive censorship and deceit. Then companies stopped accepting it directly as a result of the problems a 1mb limit causes. Now it might never happen again for BTC. The war and the signs leading up to it though spawned other cryptocurrencies, so those might succeed where Bitcoin has failed. We’re still suffering from the damage caused though as companies that stopped accepting it are now skeptical of accepting anything else again.

Edit: This is steams post on the matter - https://steamcommunity.com/games/593110/announcements/detail/1464096684955433613

1mb limit -> transaction backlog grows -> higher fees to get in next block -> transactions get delayed from fee volatility and having used the wrong fee which moments ago was the right fee -> now the heavily delayed transaction is the wrong amount due to price volatility and steam and the customer are fucked.

It kindled, and was in turn murdered as it had been intended to be used.

Crypto doesn’t avoid network fees. The fees aren’t quite as arbitrary and are shared with a broader pool of those providing the network, but the fees are still there providing the incentive for the network transactions to be processed.

Sure, and they absolutely should exist, but there’s no reason to have network fees be relative to the size of the transaction, because processing $1k vs $1 is the same amount of work.

Also businesses are not going to sign contracts on alternative currencies. Like find me an insurance company that accepts bitcoin and pays the claims* in bitcoin. And the biggest share of bank businesses is b2b banking.

* maybe they have some bitcoin if they do cybersec insurance to pay for ransomware.

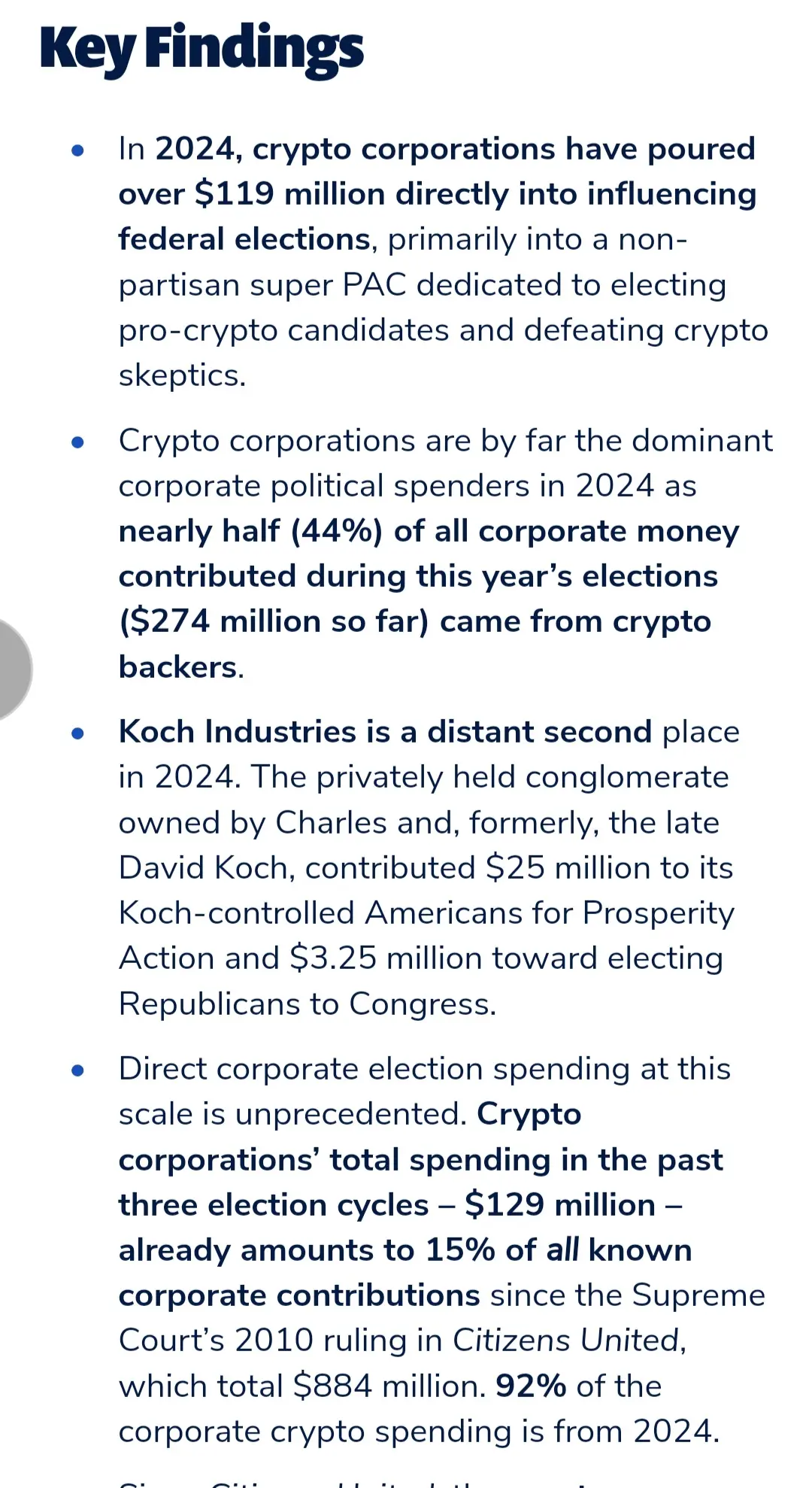

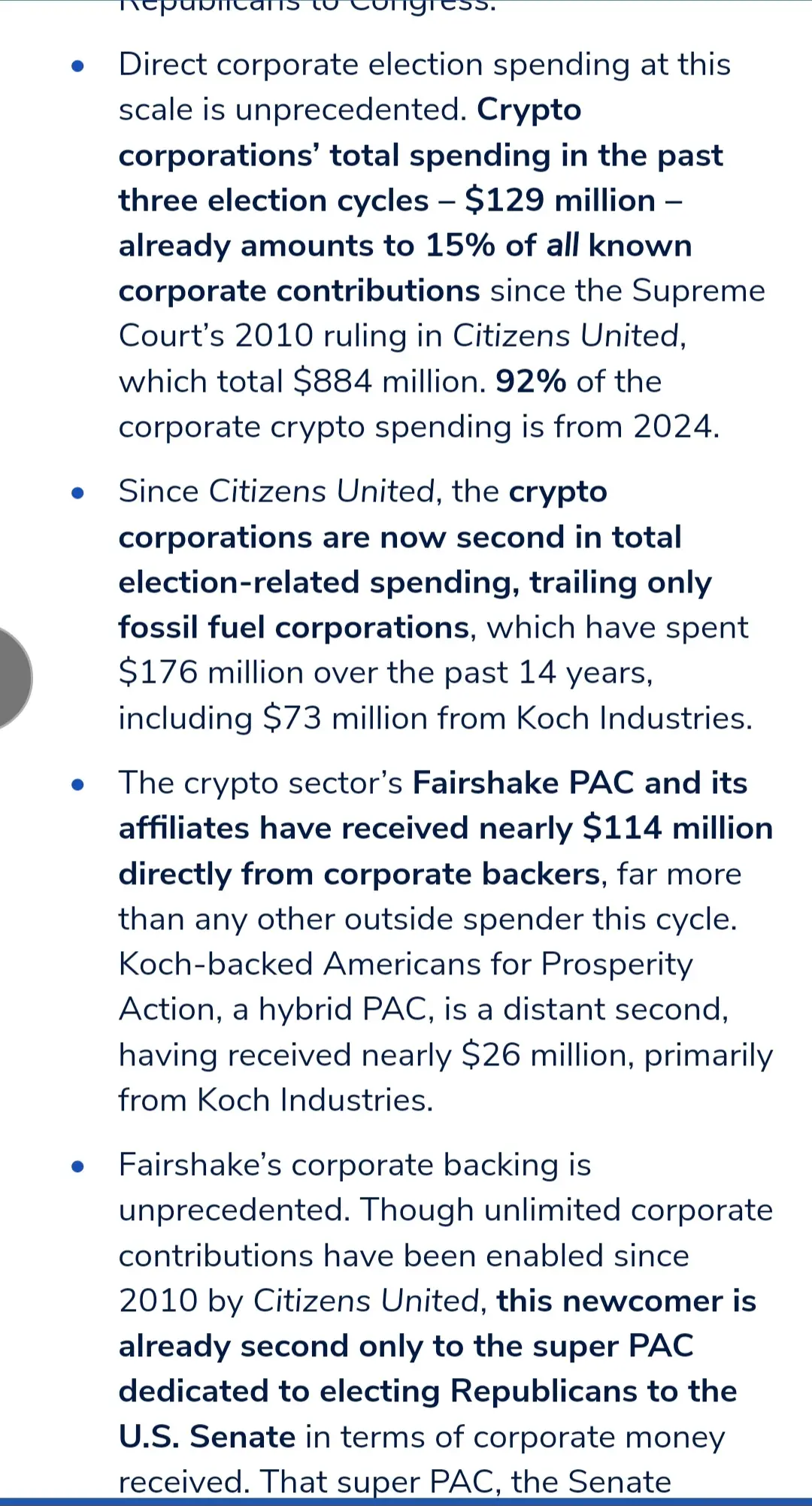

The biggest impact of digital currencies so far has been the obscene, democracy destroying amounts of money crypto bros spent to help get trump and other corrupt lackeys into office.

https://www.citizen.org/article/big-crypto-big-spending-2024/-

This is what the rise of digital currencies is an indicator of, an accelerated process of societal decay.

Your anger should be directed toward the Citizens United ruling, which makes these insane contributions possible in the first place.

FWIW, Elon Musk personally donated more than double that $129M to the Trump campaign—more than double the amount that the entire crypto industry has donated in three election cycles, despite there being a $6.6k campaign contribution limit for individuals per candidate per cycle. That limit shouldn’t be trivial to bypass, and it should be probably be lower. Or, in some fantasy land where America is something like a democracy, elections would be publicly funded with an equal amount given to each candidate.

That’s a good way to put it. Indicator of accelerated social decay. It truly is.

Don’t hate the player.

I own BTC, and disagree with crypto’s existence.

It may make my life easier to follow along in the mold society takes, even if I disagree with it. It isn’t going away just because of me. The winning team ain’t losing. Then they’d be the losing team… and not winning.

You didn’t need to tell me you own crypto, your post screams “crypto bro” at such screeching decibels that I think you just shattered a wine glass over there.

I do think that would be a superb opening monologue (set to a moody montage) for a skit taking the piss out of naive crypto bros though, well done!

Oh, boy, irrational hatred. Anything else a YouTube video told you to hate that you want to accuse me of being?

Don’t hate the player. Hate the game. If it’s between surviving in this shit world or not, I’ll take a few BTC. Put your morals in the dirt and see if anything grows out of them for all they’re worth.

People are greedy pieces of shit. They vote for it. They reward it. I’m just appealing to human nature. There’s no more good among you than there is me. You want to shun BTC? Fine. Take the long road. Your choice.

The actual act of taking some moderate sum of crypto here is meaningless to me, you were able to attain a valuable thing and so you did. It is only an intimate knowledge of the context of that choice that can inform any kind of accurate judgement fraught with grey areas as it may be.

That isn 't what interests me about crypto, what I find interesting is that no matter what rock you check under in virtually the entire crypto sphere the attitude of the creatures involved always untangles into this same precise attitude. Maybe you fall under the category maybe you don’t, my point is about the mindset of this whole enterprise that permeates it at seemingly every level.

We’re so early…

…and the hate is strong.

Id love a digital currency system to bypass banks and credit card companies trying to legislate. But the scaling power consumption of crypto is fundamentally unsustainable

I don’t really see the appeal of currency anarchy in general. Do the proponents of that really think that the power in that space wouldn’t be held by what essentially amounts to digital currency warlords (anyone with a lever to apply power and the matching lack of morals to do so)? Not to mention that some regulation of finances are a good thing, it is not as if every currency intervention by central banks is done for bad reasons.

Do the proponents of that really think that the power in that space wouldn’t be held by what essentially amounts to digital currency warlords (anyone with a lever to apply power and the matching lack of morals to do so)?

Why do you think those proponents and digital warlords are separate people?

You do make a good point but most of the levers to apply power in that space seem to be essentially controlled by how much computational power/how many nodes you can afford to run to apply control and most of the proponents are not really among the rich. They might, however, be among the ones who think they would be, sort of like the often cited temporarily embarrassed billionaires.

I do see that appeal, because we have already seen that surveilled KYC transactions are undesirable in many situations, like if you’re making a donation to a dissident. While indeed, crypto cannot scale enough to be a primary method of payment - it still needs to be there as an alternative pathway.

yeah we already have a problem with wealth inequality.

Yeah, and that would only get worse if the only controls over currency were applied by those with a lot of currency (proof of stake) or able to afford a lot of computational power (proof of work).

I agree that scaling power comsumption is unsustainable - both ecologically and ecoomically!

But power consumption is no inherent attribute of crypto, but a design choice.

Bitcoin just refuses to adjust.

Ethereum did that not very long ago.What I’m trying to say is: there are designs available that operate at a very tiny power consumption.

Don’t lump all crypto together with Bitcoin.

dictators and their goons don’t like central banks and their fiat currency that, no matter how much “money” you have, it’s their money

Wait what?

No, dictators fucking love central banks and fiat currency.

They like it even better than anything, because a dictator almost always controls the central bank. Plus, the dictator and his buddies almost always own everything, and when you own property you need fiat currency to stay in power. Fiat currency inevitably leads to hyperinflation. With hyperinflation, you get way wealthier owning property than having cash. At that point they don’t need the central bank that they control.

ok… explain to me why trump and elmo are making such a hard push to switch from dollars to bitcoin?

the federal reserve does whatever tf it wants. have you ever heard of anyone telling them what to do, and them doing it?

unacceptable for trump

I got the impression that they like crypto as an industry, not as a tool. I doubt they would guarantee safety for, as an example, KYC-less Monero exchangers.

Oh no, they absolutely won’t do that because Monero actually works as digital money that they can’t control. So there will be no protections for it. In fact, I read a paper essay thing from somebody in the European Commission that was actually talking about attacking it by the government in order to purposely suppress it.

Yes, exactly!

People like this have even less sway in a currency like Monero than they do over the Federal Reserve, primarily because a community like Monero doesn’t trust people like that. It’s a complete direct democracy, where you can make your voice heard on absolutely any issue under discussion, bring up a new issue to discuss, etc. Change does not occur unless there is an extreme majority consensus. And if a change is not liked, it either will not happen or a fork will be created.

The answer to volatility is obviously just to offer products and services in a crypto currency and then there’s no more fluctuations. If I offer a pack of AA batteries for 0.1 Monero, then it doesn’t matter what the US dollar price of Monero does because as long as you have 0.1 Monero and want a pack of batteries, you can buy one. The more merchants do this, the more stable that given cryptocurrency will become. If another merchant comes in and offers that same pack of batteries for 0.09 Monero, either the first merchant must lower their prices or must justify their higher prices with a better quality product, etc.

Edit: Yes, I already do this. https://xmrbazaar.com/user/AuroraGeneralStore/

Algorithmic stablecoins that are actually unhackable (all possible endpoints have been formally verified) exist too. They offer the best of both worlds. I’d like to see something like that on Monero’s successor (whatever that is).

edit: I was thinking that successor would be Midnight…but Midnight is closed source, which is a dealbreaker for me…especially with cryptocurrencies. Perhaps ZCash?

So far at least no algorithmic stablecoin has properly functioned for any length of time. Take a look at the Terra Luna crash for just the largest example.

Thats actually 100% false.

DJED seems to have escaped your notice. It has been humming along without incident for a full year now.

DJED is the first formally verified stablecoin protocol. The use of formal methods in the programming process has greatly contributed to the design and stability properties of Djed. Using formal techniques, the properties are proven by mathematical theorems: *Peg upper and lower bound maintenance: the price will not go above or beyond the set price. In the normal reserve ratio range, purchases and sales are not restricted, and users have no incentive to trade stablecoins outside the peg range in a secondary market. *Peg robustness during market crashes: up to a set limit that depends on the reserve ratio, the peg is maintained even when the price of the base coin falls sharply. *No insolvency: no bank is involved, so there is no bank contract to go bankrupt. *No bank runs: all users are treated fairly and paid accordingly, so there is provably no incentive for users to race to redeem their stablecoins. *Monotonically increasing equity per reserve coin: under some conditions, the reserve surplus per reserve coin is guaranteed to increase as users interact with the contract. Under these conditions, reserve coin holders are guaranteed to profit. *No reserve draining: under some conditions, it is impossible for a malicious user to execute a sequence of actions that would steal reserves from the bank. *Bounded dilution: there is a limit to how many reserve coin holders and their profit can be diluted due to the issuance of more reserve coins.

Doesnt have to be a successor to monero u can do parallel mining. Also i dont understand how can an algorithmic stable coin can exist?

That’s how all currencies work. The value is whatever we believe the value is. You could make the currency paper sacks and that would still be true.

No, it’s not.

The US Dollar is a fiat currency. The value is merely what the market dictates amongst trading frequency and how much debt is held in it.

It’s backed by nothing. A dollar has a made up value. In the1970s Nixon ended the US gold Standard, and those with property, not the government who held the gold, got to dictate it. Same thing through today.

The US dollar is backed up by you have to pay your taxes in US dollar so the US economy is going to accept US dollar, thus, if you have dollars, you can buy shit in the US. In effect, thus, the US dollar is backed by the US economy.

There’s no such mechanism for crypto coins. If you now say “well the Fed can just print money”, that’s US policy. The Euro works differently, there price stability reigns supreme, in any case the policies of both Fed and ECB are well-known and people trust that they don’t change willy-nilly because neither the US nor the EU has any interest in the fallout that would cause. That trust is in no way weaker, less of a guarantee, wrt. giving a hint at the future value of the currency as the collective faith that props up crypto coins as a unit of account.

And gold, btw, is practically useless as a commodity. Jewelry? Literally only used for that because it’s expensive. Technical applications? Do exist, but the amount needed is negligible. The value of gold relies on the existence of a luxury market.

While you have a point, paper sacks would be a bad currency because it’s decently easy to create more paper sacks and therefore inflation would run rampant quite quickly. This is why things that used to be considered money are no longer money such as seashells, glass beads, etc. It turns out they were too easy to make and inflation ran rampant until they found a harder currency.

Those things were used either because they had inherent value (gold, seashells, gems) or they were just hard enough to make for the average person (glass beads, coinage).

Paper sacks have a natural limit to being made just like everything else. Eventually you reach market stability, paper sacks are also not durable, so there would be some churn in the supply.

Well, you go ahead and use paper sacks as a currency. And let me know how that goes.

It would be like using any other commodity. Literally done every day in every major market.

National currencies are backed by people’s vested interest in the continued stability of the nation.

National currencies are backed by the fear of people who have given themselves arbitrary titles that they agree allows them to point guns at you without being prosecuted for that.

That’s a tremendously reductive perspective on what a nation is.